AI avatars are reshaping how customer engagement is done in the finance sector. Puppetry AI empowers banks and financial institutions to create brand-aligned, realistic avatars with personalization, emotion, and voice. Read here today!

Have you ever imagined logging into your mobile banking app and being greeted by an AI advisor who knows your name and understands your financial goals?

How about one that guides you through your financial journey - 24 hours a day, with no call center scripts, no hold times, but only human-like experiences?

In today's post, let's talk about how AI avatars are transforming financial services and personalized banking.

KEY TAKEAWAYS

-

AI avatars are reshaping how customer engagement is done in the finance sector.

-

Puppetry AI empowers banks and financial institutions to create brand-aligned, realistic avatars with personalization, emotion, and voice.

-

Benefits are better #CustomerExperiences, cost savings, scalable service, and consistent regulatory compliance.

-

The financial sector and firms using AI talking heads are leading the way towards smarter and “more” humanized” banking.

Enter AI Avatars in Banking

These avatars are transforming financial services, making seemingly complex banking transactions personalized and smooth.

Such AI talking heads change how banks interact with clients (loan applications, wealth management, etc.).

Platforms like Puppetry AI help banks and financial institutions deploy AI avatars faster, thanks to their outstanding scalability.

AI avatars for customer service

AI customer support agents are AI-driven digital personas that can mimic human interaction through facial expressions, speech, and real-time, human-like responses.

They engage customers in valuable ways using a combination of machine learning, natural language processing, and synthetic media.

What are the roles of AI avatars for personalized banking?

-

24/7 representatives

-

Loan and mortgage advisors

-

Onboarding and compliance navigators

-

Investment portfolio guides

-

Personalized banking assistants

Why AI is gaining traction in financial and banking services?

Customers have “smarter” expectations

People expect (and demand) personalization, simplicity, and speed. No more robotic chatbots or long wait times with AI avatars for customer service.

The cost-effective business approach

AI talking heads can handle multiple (and even thousands) of interactions at the same time. Something human agents cannot do. This can reduce staffing costs, improve team productivity, and boost operational efficiency.

Human-like interaction and engagement

AI avatars can bring a human touch to financial services and banking space with human-like tone variation and facial expressions.

Consistency with regulations

AI avatars will never forget compliance protocols, with disclosures and scripts directly embedded into their programming.

[The Financial Industry Regulatory Authority emphasizes that firms should maintain proper governance and supervisory systems when using AI tools to ensure that the communications generated meet accuracy and fairness standards regarding content. Source]

Puppetry Behind AI Financial Assistants

One of the go-to AI tools powering these AI customer support reps/assistants is Puppetry AI, which is already empowering financial institutions to create human-like avatars that represent their customer values and brand voice.

Key Features of Puppetry AI

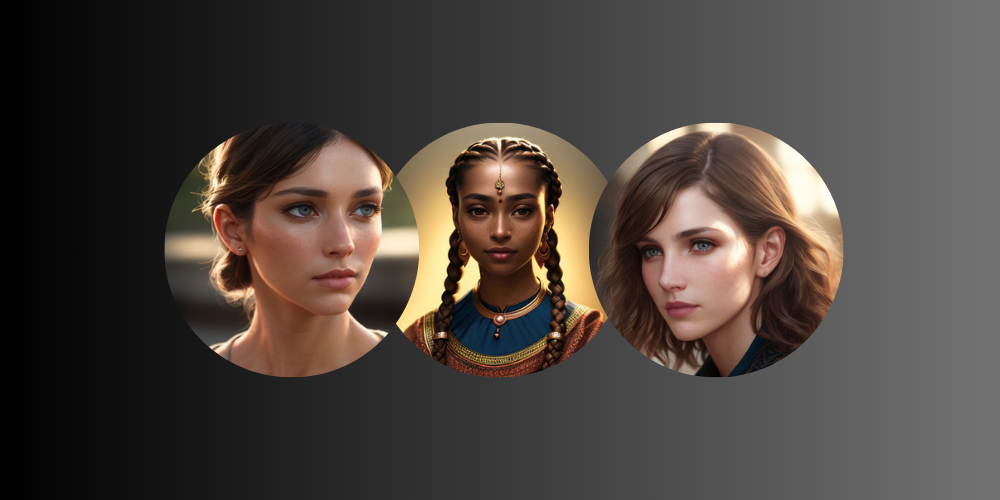

Customizable avatar designs: Users can build avatars to become brand ambassadors or representatives. In the studio, they can use the AI puppet generator online to create their brand avatar.

Choose hair, skin, and eye colors, or add style with an origin, like American, Asian, African, or European, and style options, such as sophisticated, business, trendy, or casual.

Voice-to-video animation: Upload the script for what you want your AI talking head to say or audio to convert audio to animated video responses with accurate lip-syncing.

Multilingual support: Do you serve audiences from around the globe? Use puppetry AI for avatars that do not need training to speak multiple languages fluently. This AI tool for business offers over 400 standard voices. (Plus, you can clone your voice.)

Creating your intelligent and on-brand digital advisor is no longer impossible. With AI-powered video generators, it’s accessible and available for all small or big banks.

AI Avatar Real-World Applications in the Banking and Financial Service Sectors

The future is here.

AI is no longer a concept—it is already in fintech platforms and banks.

KYC & Onboarding Guides

Guided interaction with AI avatars can help your clients upload identification documents, understand privacy and terms of service, and complete verification steps.

Internal Employee Training

Use an AI talking head to explain policy changes, train employees with AI, and onboard new hires. It’s cost-effective, scalable, and efficient.

AI in customer service

Attend to customer queries in real-time, 24/7, with AI agents in support or sales. Help clients understand what they need to know about retirement options, credit card usage, or savings goals instantly in plain and straightforward language.

Investment assistants

Explain trends, monitor portfolio performance, and deliver market insights through a human-like digital financial advisor.

AI mortgage and loan advisors

Offer solid guidance to customers regarding pre-qualification, interest options, and mortgage terms in an understandable and friendly manner.

AI Avatar Benefits for Personalized Banking

-

Scalable and personalized banking technology: Hyper-personalized interactions (product recommendations, financial advice, etc) tailored to each customer with artificial intelligence tapping into user data.

-

Brand loyalty: Create stronger emotional engagement with human-like talking heads to increase customer retention and trust.

-

Conversion rates: Make product explanations more engaging (and simpler) with these puppets, and watch your conversion rates soar high. Customers can decide faster if they understand the benefits of your offers (loan, opening a bank account)

-

24/7/365 services: AI talking heads do not sleep, offering real-time services to customers wherever they are (no matter the timezone). This improves customer satisfaction and your service’s accessibility.

-

Competitive advantage: AI puppets for customer service are customer-centric and tech-forward, especially appealing to digital natives.

Digital Empathy Is the New Currency

Human + Digital - the new frontier in banking. AI avatars represent the intersection of humanity and technology.

They can provide customers personalized engagement, real-time services, and professional brand storytelling.

Puppetry AI and other AI video platforms for finance make it easy for small or large firms to bring digital experiences to life - and all with a smarter brain and a friendly face. Build deeper connections with clients while positioning your brand as an innovation leader.

So, it’s about time to welcome your new team member: YOUR AI AVATAR.

![How to Use AI for Coaching in 2024 [+ 6 AI Tools for Coaches]](/_next/image?url=%2Fimages%2Fhow-to-use-ai-for-coaching-I3Mz.png&w=828&q=75)